Revealed: the best time to buy car insurance to save £550+/yr

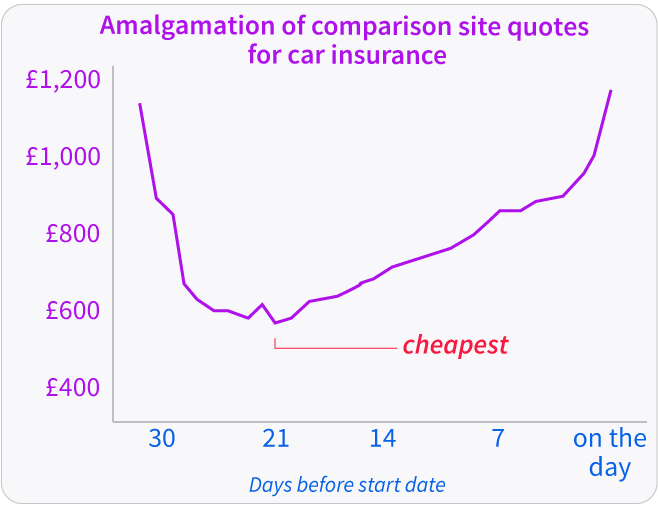

With car insurance, like comedy, it seems timing is everything, according to new data compiled by the UK’s biggest consumer website, MoneySavingExpert.com. The optimum time to buy is 21 days before the new policy starts (which will be at renewal for most) – too early, or too late and the price shoots up. For a typical policy that would cost £1,156 on renewal day, it's £589 three weeks earlier.

The website analysed more than 18m quotes from January to May (after requesting data from comparison sites Compare the Market, Confused.com and MoneySupermarket) and discovered huge price variances depending on when you get a policy.

Remarkably, being overly organised and getting your insurance too early could also mean you’re overpaying by £100s. A typical policy bought 30 days in advance – the earliest you can usually get a quote on comparison sites – could be £531 more expensive than buying 21 days ahead.

Martin Lewis, founder of MoneySavingExpert.com said: "Car insurance pricing is based on a mix of actuarial risk and which section of the market is targeted. To find the risk they look for patterns, and we've uncovered that one of those is how early you get a quote before renewal. To avoid being a last-minute loser, everyone with car insurance should at the very least, put a note in their diary 25 days before renewal to sort it within a week."

For more on this and other tips for getting a cheap deal on car insurance, visit the MSE news story.