MoneySavingExpert News

Mortgages

Interest rates on fixed mortgage deals are expected to fall over the coming weeks, despite the Bank of England increasing the base rate to 4%. If you need a new mortgage in the coming months, we've analysed the landscape and spoken to a number of brokers to help you navigate this uncertain market.

7 February 2023

Interest rates on fixed mortgage deals are continuing to fall with hundreds now below 5% and many closer to 4%. But with fixed mortgage rates expected to drop further, is now a good time to lock in? Below we explain what's happening, and what to consider if your deal's coming to an end.

11 January 2023

Flat-owners impacted by the cladding crisis in England may now be able to sell or remortgage their homes, with six major lenders agreeing to offer mortgages under new industry guidance. But the measures only cover properties in buildings of 11m and over and so not everyone affected will benefit – and we're yet to see how it will work in practice. Here's what we know so far.

10 January 2023

Homebuyers with small deposits will continue to have access to Government-backed support after its 'mortgage guarantee scheme' was extended this week for another year. But even with the difference in cost between mortgages for those with a 5% deposit and those with a 40% deposit at its narrowest in over 10 years, is it wise to take out a 95% deal? We explain your options below.

21 December 2022

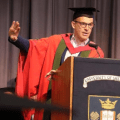

Mortgage lenders have been pushed to offer more support for struggling homeowners following a meeting with MoneySavingExpert.com founder Martin Lewis, the Chancellor Jeremy Hunt, and the financial regulator. The move comes as homeowners continue to face higher and significantly more expensive interest rates amid the cost-of-living crisis.

8 December 2022

If you've secured a mortgage rate, but that deal hasn't yet started, it's worth checking now if you can get a cheaper rate, as many offered on new mortgages are now lower than they have been in the last few weeks. Most lenders won't charge you a fee to cancel, and a cheaper deal could save you £100s.

22 November 2022

Suggest a story

Got a money-related news story that affects you? Email us