Autumn Budget 2025: Martin Lewis' reaction and analysis – tax thresholds frozen again, cash ISA cut, EV pay-per-mile and more

The Chancellor Rachel Reeves has announced a raft of changes to income and property taxes, cash ISAs, benefits, transport and more in her Autumn Budget today (Wednesday 26 November). MoneySavingExpert.com founder Martin Lewis has shared his reaction and explained what the changes mean for you, and we've added more detail on them below.

A round-up of today's announcements

Follow the links for more info:

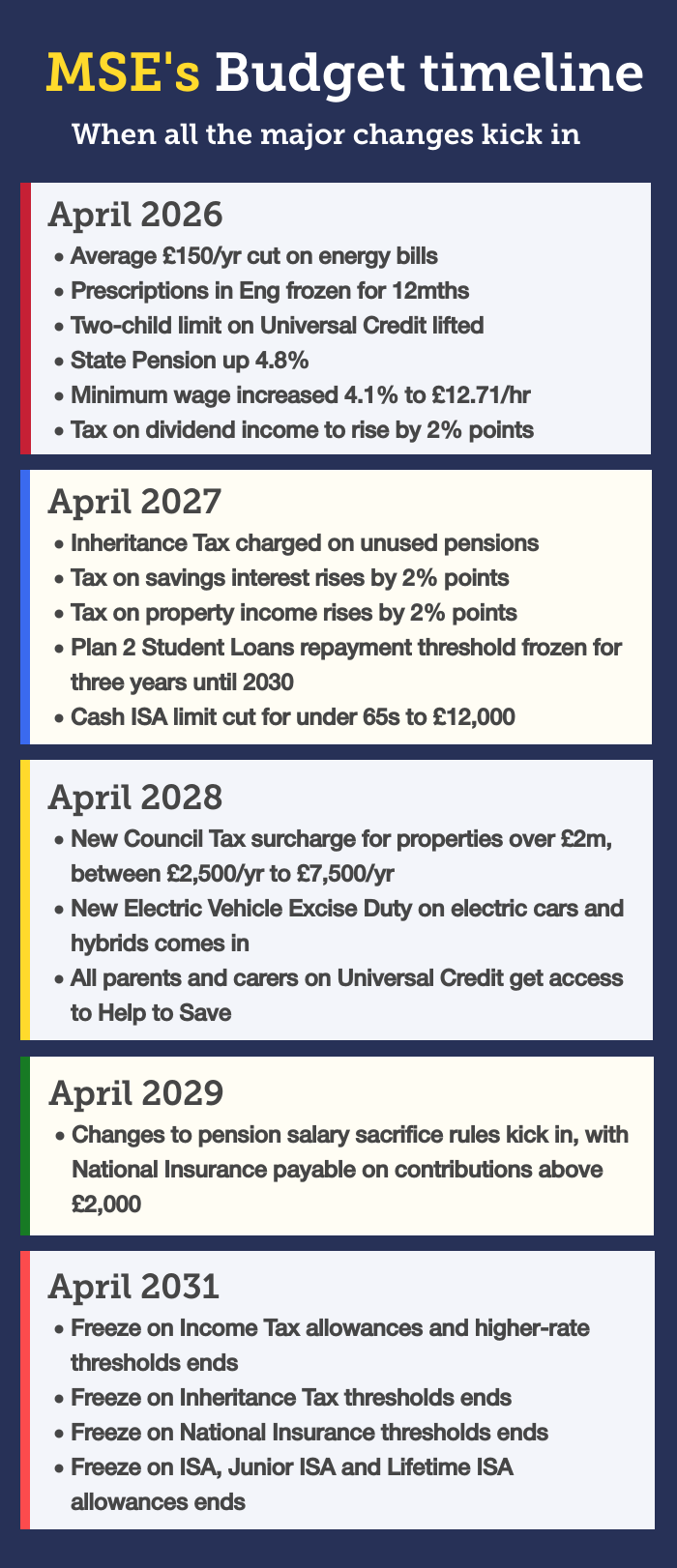

From April 2026...

From April 2027...

From April 2028...

-

Income Tax and National Insurance thresholds frozen until 2031.

-

Owners of properties worth £2m+ to pay extra £2,500+ a year.

Other measures...

£150 to be cut from energy bills

The costs of certain green schemes will be removed from household energy bills from April 2026, saving a typical dual-fuel household around £150 a year on average, according to the Government.

Both gas and electricity unit rates will be reduced, but the reduction will largely be seen on electricity bills. Martin has urged the Government to ensure these savings are passed on to consumers on fixed energy tariffs.

State Pension set to rise by 4.8%

The Chancellor is expected to confirm that 13 million pensioners will see an above-inflation rise to the State Pension next April, after the Government said on Sunday 23 November that both the new and old (basic) State Pension will rise in line with average wage growth between May and July – which stands at 4.8%.

This uplift comes under the so-called 'triple lock', which guarantees that the State Pension increases annually by the highest of September's Consumer Prices Index (CPI) figure (which stood at 3.8%), or average earnings growth between May and July, or 2.5%.

This means that:

-

The full New State Pension will rise from £230.25 to £241.30. You'll be on this if you reached State Pension age after April 2016.

-

The full Old State Pension will rise from £176.45 to £184.90. You'll be on this if you reached State Pension age before April 2016.

Nearly two-thirds (64%) of state pensioners are on the Old State Pension, so they'll see a smaller cash increase.

The Guarantee Element of Pension Credit – a top-up benefit for low-income pensioners – will also increase by 4.8%. This means the amount per week for a single pensioner will increase from £227.10 to £238 a week and for a couple it'll increase from £346.60 to £363.25 a week. The Savings element of Pension Credit will increase by 3.8%.

For State Pensioners who have no other income, the Government says it will "ease the administrative burden... so that they do not have to pay small amounts of tax via Simple Assessment from 2027-28", if the State Pension exceeds the tax-free personal allowance from that point. But we don't yet know what this will look like in practice.

The national minimum wage will rise by 4.1%

From 1 April 2026, the national minimum wage paid to workers aged 21 and over will rise by 4.1%, increasing from £12.21 an hour to £12.71 an hour – meaning an increase of around £900 a year for a full-time employee.

The minimum wage will also rise by 8.5% for those aged between 18 and 20, going from £10 an hour to £10.85 an hour – or £1,500 a year if working full-time. For 16 and 17 year-olds, and those on apprenticeships, the minimum wage will rise by 6%, going from £7.55 an hour to £8 an hour.

However, the minimum wage rate is still lower than the 'real living wage', a voluntary employers' pay scheme based on the cost of living that covers some 500,000 workers. Last month the Living Wage Foundation, which sets the rates, upped wages by 6.7% to £13.45 an hour and to £14.80 an hour for those in London.

Universal Credit to rise by 6.2% and some other benefits by 3.8%

Universal Credit will be uprated UK-wide from April 2026, though by how much depends on your age and circumstances:

-

The basic amount you get – the 'standard allowance' – will rise for most new and existing claimants by 6.2%, except for single claimants under 25 who will see a rise of 6.8%.

-

The amount you get if you can't work because of sickness or disability – the 'health element' – will be frozen at just under £99 a week until 2029/30 for those who started claiming before 6 April 2026. If you make a new claim on or after 6 April 2026, you'll get £50 a week instead.

-

The current two-child limit on the 'child element' will be removed. From April 2026, the child element for the first child born prior to 6 April 2017 will increase from £339 a month to £351.88 a month, while the amount for the first child born on or after 6 April 2017 will increase from £292.81 to £303.94 a month. The amount for any additional children, regardless of when they were born, will also increase by this latter amount (£11.13 a month).

Most other working-age benefits across England, Northern Ireland, Scotland and Wales will also go up by 3.8% from 6 April 2026, though we don't yet have a full list of proposed benefits rates for 2026/27. Local Housing rates and the overall benefits cap – which is the limit on the total amount of benefit you can get – will be kept at their current levels and not increased for 2026/27.

In Scotland, the levels of certain benefits, such as Carer's Allowance and the Personal Independence Payment, are decided by the Scottish Government – we are unlikely to hear about any potential changes until the Scottish Budget is announced on 13 January 2026.

Two-child Universal Credit limit to be lifted

In simple terms, the current limit means that, if you get Universal Credit, the child element of it only applies to the first two children you have. Scrapping this limit from April 2026 will lift 450,000 children out of poverty, the Government says.

It's important to note this is completely separate from Child Benefit and the overall benefit cap, as Martin explains:

The Government has announced it's ending the two-child benefit limit, but there's a lot of confusion about what it is. So here is a bit of a primer...

1. It is nowt to do with Child Benefit, a universal payment for every child you have (clawed back from higher earners).

2. The two-child benefit limit, often wrongly called a cap, means those who get Universal Credit – a benefit for those in and out of work on lower incomes – won't get any additional benefit if they incur extra costs because they've more than two children. This is what is being scrapped in April, so they will get more benefits if [they have] extra costs from more children.

3. Separately there is also a Benefits Cap – which, in simple terms, is a max amount you can get on benefits (including Universal Credit and Child Benefit). The cap for families, couples and single parents is £1,835 a month. It's more in Greater London.

So there you go. You've got Child Benefit rules, the two-child limit for Universal Credit, and a benefits cap. There are lots of ifs and buts. I hope that helped clear it up a bit.

Some rail fares in England frozen

Annual increases to 'regulated' rail fares in England are usually linked to the previous July's retail prices index (RPI) measure of inflation, which for 2025 stood at 4.8%.

However, ahead of today's Budget, the Government confirmed that regulated rail fares in England will be frozen until March 2027 – the first freeze in 30 years.

Regulated rail fares include season tickets, anytime day, off-peak, and super off-peak tickets. Unregulated fares include first class, advance, anytime and off-peak day tickets – the cost of these fares is set by train companies.

The Scottish, Welsh and Northern Irish Governments are in charge of setting rail fares in their respective countries. We've contacted all three Governments to find out what their plans are and will update this story when we know more.

Prescription costs in England frozen

The cost of a single prescription in England will remain at £9.90 for 2026/27. This is an extension of the freeze implemented following last year's Budget.

The three-month and 12-month prescription prepayment certificates (PPC) will also remain frozen at £32.05 and £114.50 respectively, while the Hormone Replacement Therapy PPC will stay at £19.80.

NHS prescription charges apply in England only; prescriptions in Scotland, Wales and Northern Ireland remain free.

The freeze will also apply to NHS wigs and fabric supports, such as surgical bras, and abdominal and spinal supports – these prices will remain at current levels.

Cash ISA limit to be cut to £12,000

ISAs are savings or investment accounts you never pay tax on. Currently, you can add up to £20,000 into one or more ISAs each tax year – and you can freely split this allowance between cash ISAs and stocks & shares ISAs.

From April 2027, if you're under 65, the amount you can save into a cash ISA will be reduced to £12,000 a year. The Government says it's making the change to encourage more people to invest. For those who are 65 or older, the £20,000 annual limit will remain in place.

Importantly, however, your overall ISA allowance – the amount you're able to contribute across different ISAs in one tax year – will remain at £20,000, regardless of age. This means you could save £12,000 in a cash ISA and an additional £8,000 in a stocks & shares ISA, for example.

Martin, who has previously voiced concern about a cut to the ISA limit, says the change "isn't as bad as it could've been".

More tax on savings interest, dividends and property income

The Government says it's aiming to "narrow the gap between tax paid on work and tax paid on income from assets". So it's making the following changes:

-

If you pay tax on dividend income from investments, your rates will rise from April 2026. You pay this if you hold investments outside a stocks & shares ISA, your overall income exceeds your personal allowance (currently £12,570 a year), and your dividend income exceeds your annual dividend allowance (currently £500 a year).

Tax on dividend income will increase by 2 percentage points. The ordinary rate will rise from 8.75% to 10.75%, and the upper rate from 33.75% to 35.75% from April 2026. The additional rate will remain unchanged at 39.35%. -

If you pay tax on savings interest, your rates will rise from April 2027. Most people don't pay any tax on savings interest, either because their money is in an ISA, or because their interest is covered by their tax-free savings allowances.

For those who do pay tax on savings interest, the basic rate will rise from 20% to 22%, the higher rate from 40% to 42%, and the additional rate from 45% to 47% from April 2027. -

If you pay tax on income from property, your rates will rise from April 2027. Currently, you pay the standard rates of Income Tax on property income above any allowances.

From April 2027, property income will have its own, separate rates (as is already the case for savings and dividend income). These property rates will be 2 percentage points higher than the current general Income Tax rates – the property basic rate will be 22%, the higher rate will be 42%, and the additional rate will be 47%.

Plan 2 student loan holders to repay more

Currently, if you're on a Plan 2 student loan – which is all English students who started university between 2012 and 2022, and Welsh students who've started since 2012 – you pay back 9% of anything you earn above a certain threshold, currently £28,470 a year. For example, earn £38,470 and you'd repay £900 (9% of £10,000).

In England and Wales, this threshold will rise to £29,385 a year from April 2026. However, it will then be frozen at that level in England from 2027 until 2030 – effectively increasing the amount you have to repay over time.

It's not yet clear if this freeze will also apply in Wales. The Welsh Government, which is responsible for setting the repayment threshold for Welsh borrowers, says it is "undertaking a careful assessment" of the potential impact, adding: "It would not be appropriate to make a decision at this stage that could bind a future Welsh Government."

Income Tax and National Insurance thresholds frozen

National Insurance thresholds across the UK and Income Tax thresholds in England, Wales and Northern Ireland – which determine when you start paying each tax – will be frozen until April 2031. The thresholds had been due to start rising again from April 2028.

Responding to the announcement on X, Martin explained that this is effectively a "stealth tax", adding: "Freezing thresholds while average earnings rise means people pay a bigger proportion of their income in tax."

According to the Office for Budget Responsibility, the freeze in tax thresholds will result in 780,000 people being dragged into paying Income Tax for the first time, while 924,000 will be pulled into paying higher rates. This process is known in economic jargon as 'fiscal drag'.

The Scottish Government sets its own thresholds for Income Tax – we are unlikely to hear about any potential changes until the Scottish Budget is announced on 13 January 2026.

Electric vehicle owners to pay-per-mile

A new mileage-based charge on electric vehicles will come into force from April 2028, with the average EV driver set to pay around £240 per year or £20 per month, according to the Government. This will be in addition to the current Vehicle Excise Duty (VED) paid by EV and non-EV drivers alike.

Battery-powered cars will pay 3p per mile, roughly half the rate of fuel duty tax paid per mile by drivers of petrol and diesel vehicles. Meanwhile, plug-in hybrid vehicles will pay the equivalent of 1.5p per mile. These rates will rise every year in line with inflation.

How it could work in practice

The Government has launched a consultation on the introduction of the new charge, which will run until 18 March 2026. Until that concludes, we won't know the exact details.

Under the current proposals, however, you would estimate your mileage for the year ahead, pay an upfront charge or spread the payment across the year, and then submit your actual mileage at the end of the year to see if you're due a refund or need to pay more (with your mileage being checked as part of your MOT, as is the case now).

There will be "no requirement to report where and when miles are driven or install trackers in cars", the Government says.

Owners of 'high value' homes to pay £2,500+ a year from April 2028

A new Council Tax surcharge will be applied to properties in England worth £2 million or more from April 2028, to be paid in addition to your normal rates of Council Tax. The Government says the surcharge is being introduced to help fund local government services.

To identify which properties are affected, the Valuation Office will "conduct a targeted valuation exercise". Fewer than 1% of properties in England are expected to be above the £2 million threshold, the Government says. Those that are will be charged:

-

£2,500 a year if worth £2 million to £2.5 million.

-

£3,500 a year if worth £2.5 million to £3.5 million.

-

£5,000 a year if worth £3.5 million to £5 million.

-

£7,500 a year if worth over £5 million.

The rate of the surcharge will rise in line with the Consumer Prices Index measure of inflation each year, while revaluations of properties will take place every five years. An initial consultation in relation to the surcharge will take place in 2026.

Help to Save scheme to be expanded

Help to Save is a cleverly designed scheme to encourage savings among those in work who can't normally afford to save – helping people gain financial resilience, so they can use their own cash in an emergency rather than high-cost credit, and rely less on the state.

The scheme lets you put away up to £2,400 (£50 a month) over four years, which is then boosted by a Government bonus of 50% on the highest amount you had in the account – no other form of saving comes close.

Help to Save was expected to end in 2027, but the Chancellor has announced that it will be made permanent and opened up to an extra 1.5 million people from April 2028. This will be done by expanding the scheme to cover everyone getting the 'carer's' element or 'child' element of Universal Credit, including those unable to work due to caring or parental responsibilities.

Salary sacrifice pension perk to be capped at £2,000 a year

Salary sacrifice lets you 'give up' some of your salary in exchange for your employer paying the difference into your pension. Under the current rules, you don't pay income tax or National Insurance (NI) on the amount you sacrifice via the scheme.

However, from April 2029, the NI relief you get using the scheme will be capped at £2,000. This means some middle- and higher-earners are likely to get slightly less take-home pay. So if, for example, you make a 5% contribution via salary sacrifice to your pension and earn £40,000 or less, you won't be affected by the change.

Chancellor writes to regulator over mid-contract price hikes

Last month, O2 announced that all of its existing mobile contract customers would see their bills rise by 40% more than they were originally told.

In response, Martin wrote to the Chancellor calling for urgent action to strengthen regulator Ofcom's existing consumer protection rules, which he warned O2 had "circumnavigated".

The Budget documents published today stated that the Chancellor was "working alongside Ofcom to ensure customers get a fair deal and are able to switch provider easily" – and the Chancellor has now written to Ofcom asking it to review the "suitability" of its rules, as Martin had suggested.

Lifetime ISA to be scrapped for new savers

Lifetime ISAs (LISAs) are designed to help people aged 18 to 39 buy their first home or to save for retirement. Savers get a 25% Government boost when they use the funds to buy a qualifying first home.

But the scheme's £450,000 property price limit has remained frozen since LISAs launched in 2017, despite property prices rising significantly since then. This has left some first-time buyers unable to find a suitable property under the limit, and savers buying a home that no longer qualifies are then effectively charged a 6.25% penalty on their own money when withdrawing – something we've been campaigning to fix since January 2023.

The Chancellor has now set out plans to consult on a new scheme for first-time buyers to replace the existing LISA scheme. The consultation will be published in early 2026. As part of this, we understand the Chancellor will look into increasing the LISA property price threshold for existing savers.

Fuel duty frozen (again)

This UK-wide tax on petrol and diesel will remain at 52.95p a litre as the temporary 5p cut has been extended again and will now expire at the end of August 2026, after which it is scheduled to rise.

Alcohol duty to rise

The tax charged on alcohol will rise by 3.66% on 1 February 2026, in line with the Retail Price Index measure of inflation.

If the rise is fully passed onto consumers, it would mean an extra 2p on a standard pint (4.5% alcohol by volume) and an extra 3p on a glass of wine (12% alcohol by volume).

Buying from retailers such as Shein and Temu could become more expensive

The Chancellor announced that she would be closing a tax loophole that allows certain online retailers to sell cheap overseas goods in the UK without paying Customs Duty (essentially a charge for buying things overseas and importing them into the UK).

Currently, the Duty – which can be as high as 25% – is not charged on small parcels worth £135 or less. As a result, firms such as Shein and Temu, which generally sell lower-value items and ship them directly to consumers, can often undercut high street retailers.

The Government has launched a consultation into how it should start levying import charges on all items, regardless of value. It ends in March next year, and the Government wants to scrap the relief on small parcels by April 2029 at the latest.

What we don't know is whether online retailers importing overseas goods will pass these additional costs onto you when they come in – but either way it's unlikely to impact you immediately.