23 property search tips

How to find your dream home

It's the biggest purchase of your life, and even small mistakes can be costly. So we've drawn up a house-buying battleplan, which has 23 tips for first-time buyers and home movers – including squeezing sellers for information, doing your own research, spotting hidden costs, a deal-breaker checklist, plus how to buy at auction.

-

Get browsing with free property search sites

You're not limited to peering into estate agents' windows to see what your money might get you. There are also free property search websites.

But bear in mind asking prices are often optimistic, showing what the seller wants, not what they'll get.

So ask yourself: does the type of property you're looking at stay around for a while, or is it normally snapped up quickly? Is there a steady supply of this type of property, or are homes like this few and far between?

-

Rightmove. The UK's most well-known property portal, Rightmove, due to its sheer scale there's nowhere better online to begin comparing homes for sale.

-

Zoopla. The UK's other big property portal, Zoopla is another great place to begin your property search. It's worth using Zoopla alongside Rightmove.

-

OnTheMarket. Get early bird access through OnTheMarket, which features thousands of properties before they hit the likes of Rightmove and Zoopla.

-

Home. MoneySavers also rate Home.co.uk, another big free portal.

-

-

Chat to your local estate agent

Some homes are sold before they appear online, so it's worth speaking with your local estate agent and asking them to let you know as soon as a place hits its books. Give them the type of property you're looking for and your budget.

Estate agents should be able to indicate how realistic your search is, how many buyers you'll likely be up against and how long it's taking similar properties to sell.

Estate agents see lots of buyers, so be friendly and make sure they know you're a serious buyer. Then they might do some of the property search legwork for you and give you a heads up when something new becomes available.

-

Find out how much other homes have sold for

You can also use the internet to see what any property, anywhere, has sold for in past years. This can be done for free via Zoopla and Rightmove.

What's more, you can often find old property adverts on Zoopla and Rightmove, including pictures, asking prices, descriptions and floor plans. This information can help you answer questions like: "72 Acacia Avenue sold for £300,000 two years ago, but was it a neglected bedsit or a plush 3-bed with kitchen island and walnut floors?".

Also see our Free house price valuations guide, which explains how to find out more about a property, such as its local amenities, crime stats and flood risk.

-

Property prices can go down as well (not just up)

A warning from MoneySavingExpert founder Martin Lewis:

Martin LewisMSE founder & chair

Martin LewisMSE founder & chairNo one can tell you what will happen to house prices, though many will try.

I once did an ITV News debate with an estate agent and a City economist. The first predicted strong house price growth, the other a 30% crash. I said: "Anyone who tells you they know what will happen is talking nonsense. No one knows." To which they said "rubbish!"

Remember, property is an asset just like any other. Just as no one can always guarantee to call the stock market right, the same's true of the housing market.

-

Check out the local area before making an offer

No matter how nice the property, MoneySavers are unanimous that location counts. You might be able to do a home up, but you can't move it to another spot.

So explore the local area in person. Visit the parks and pubs. Are homes well-maintained? Do you like the shops and restaurants? Speak to people who live there, as they're likely to tell you the truth and give a better picture. Also try the internet – Reddit and Mumsnet often have informative threads on different areas.

Check your specific property too – are neighbours noticeably noisy? Is it under a flight path or next to a train line? Are there upcoming planning proposals nearby?

Police crime-mapping websites show local hotspots and break down recorded crimes such as burglary and anti-social behaviour. Elsewhere, there's free information on school league tables and noise level and air quality checks.

-

Watch out for flooding risk

Flood risk has a significant impact on the cost of insurance, a property's value and – if you're unlucky enough to be hit by water damage – your quality of life.

There are websites which provide detailed reports on whether an area is at flooding risk. These reveal how vulnerable a property is, possibly saving years of stress.

England. See Gov.uk.

Scotland. See Environment Protection Agency.

Wales. See Natural Resources.

Northern Ireland. See NI Direct.

Don't leave flooding risk to chance. Forumite spannerzone learned the hard way:

I'd never buy in a risk zone again. My concerns would be around getting insurance as well as the life-changing mess flooding can cause.

It seemed highly unlikely flooding would ever happen to me, so I never gave it any real thought. The day it flooded and every single item I owned got ruined was somewhat of an eye-opener.

-

Check what's being built (or planned) in the area

Is a new high-rise being built nearby? Or perhaps a busy new road that'll increase traffic significantly?

To avoid surprises such as these – which can potentially impact the value of a property – you should check for nearby planning applications. You can normally search by postcode and area.

England and Wales. See Gov.uk.

Northern Ireland. See the Northern Ireland Planning Portal.

Scotland. See your local authority's website.

This way, if you know the street you're looking at will be part of a building site for the next three years while a new development is built, you'll not be surprised if building starts the week you move in. Check before you put in an offer.

-

Use apps to monitor for-sale listings on the go

Both Rightmove and Zoopla have free apps which help to pinpoint homes for sale near to where you're standing – meaning you don't need to search by road name.

The apps also allow you to check millions of house prices dating back to 1995.

-

Squeeze sellers for info before putting in an offer

Before making an offer, ask as many questions as possible. Get important answers in writing if you're likely to forget and follow up if you get a half-answer.

Here are our top questions to ask:

- How many viewings has it had?

- How many offers has it had?

- How long has it been on the market?

- Can I see electrical and gas installation checks/reports?

- How long is the lease (if it has one)?

- Have there been any neighbour disputes?

- Why are the vendors moving and are they sure they want to sell now?

- What renovations have been done?

- How old is the boiler and when was it last inspected?

- When was it last rewired?

- Where are the vendors moving to – is there a chain?

- Is there a service charge? If so, how much does it typically increase by?

- Who lives upstairs/downstairs/next door?

- How long has the seller lived there?

- What's included in the sale? White goods? Curtains? Wood burner?

- Is there an allotted parking space/residents' permits?

- If there's a real fireplace, is it safe to use?

- Have there been any subsidence problems?

- What's the council tax band? -

Take snaps when viewing

Take photos, as they'll be a useful reference point when all the homes blur into one. Check with the estate agent first, but don't feel like you're being cheeky.

As one home seller on the forum, Gorgeous George, says:

Photos are fine. If I thought letting a potential buyer take some pics might clinch the sale, I'd have special lighting set up by the BBC.

-

View at different times of day

View a property at different times of day. While daylight makes spotting flaws easier, pounding music from the neighbours may not begin until they've got back from work.

Even if you can't get into the property, it's worth standing outside – you'll hopefully still hear any noise.

MoneySaver InTheRed2009 has a cautionary tale.

I viewed my flat just once before buying, and within an hour of actually moving in the music started thumping through from upstairs. This is still an ongoing problem. I viewed just once, during the day, and it was quiet, so assumed there was no problem.

-

Get alerts on your favourite streets

If you want to get a notification as soon as a relevant property hits the market, set up an instant alert on Rightmove. Simply create an account, enter your preferred search criteria and hit the 'create alert' button – hopefully it'll give you an edge.

-

Know your potential deal-breakers

You don't need to spend money on a survey to discover obvious problems. When viewing, look out for the following, and consider if any of them are a dealbreaker for you:

Spot damp. Check for wet spots, mould, peeling wallpaper and condensation on windows. Also check the floor – is it uneven, suggesting damp? Check cupboards too. Does the house smell musty? These are all tell-tale signs.

Look up at ceilings. Check for cracks, brown stains, slow drips, mould, leaks.

Open doors and windows. Make sure they all work. Open cupboards and drawers to check they close properly.

Flick switches. Turn lights on and off, especially those with older switches. Try turning on the cooker and check the wiring's age, as rewiring can be pricey.

Count power points. Mark out power point locations in each room on the floorplan. Check sockets carefully – do they look like they'll work?

Inspect the plumbing. Flush toilets and turn on taps. Check cupboards underneath sinks are dry. Check water pressure and that it gets hot. Lift the drain covers and flush the loo to check the drain's flow.

Feel the heat. Ask if you can switch on the boiler and central heating. Check radiators for leaks and rust. Make sure the radiator's entire surface gets hot.

Locks are key. Ensure door locks are up to insurance standards. Check windows for locks and the front door for break-in signs.

Watch out for woodchip. Buying a house with woodchip or other textured wallpaper slapped all over it usually means excavating through layers of paper.

Lift mats and rugs. Check for stains lurking underneath.

Check your phone. Confirm it's not a 4G/5G dead zone.

Audit the attic. Inspecting the loft in daylight is a great way to gauge the state of the property's woodwork. Check timbers for rot, as well as cracks or holes.

Observe outside walls. Check for cracks, mould and rotten woodwork.

Look at the roof. Check for missing/slipped tiles. Eye up the gutters and woodwork too. If possible, go on a rainy day, to see if the gutters leak.

Kitchen nightmares. Is there enough room, or are you struggling?

Take a compass. Check if the claim of a sunny south facing garden is true.

Pry next door. Are neighbouring properties run-down? While not necessarily an issue, their problems can quickly become yours.

Vet the seller. Do they seem unreliable? A property is not good value if the vendor doesn't really want to sell it. You could end up wasting £1,000s in fees.

Small issues such as a broken kitchen drawer needn't be a deal-breaker. But make a list and ask the seller to fix them before you get the keys.

-

Speak to the neighbours

Neighbours may offer helpful insight about the area or property. This is also a chance for you to get the measure of them. Check how well maintained their home is – look for junk abandoned at the front and gardens engulfed by weeds.

It's also worth chatting to neighbours near, but not next to, the property.

-

Find homes where sellers DROP prices

The likes of Rightmove, Zoopla and Nethouseprices not only let you track when properties hit the market, they also indicate if asking prices have been reduced. Where the price has been slashed, you'll normally be able to see how much by.

A property that's had its price reduced can give you greater bargaining power.

-

Will you be able to sell the property in future?

If this property isn't your 'forever home', consider ease of resale. While this may be your ideal home now, is it likely future buyers will feel the same way?

Where the property's been on the market for a while, consider why it hasn't shifted yet. Are people put off by the street, a takeaway below, lack of parking or an unkept garden?

-

Beware of leasehold homes with a short lease

If you buy a leasehold property, you effectively lease it from the freeholder. That's because the freeholder owns the land on which the property is built.

Where a leasehold property has less than 80 years left on its lease (even by just one day), a lease extension becomes very costly – we're talking £10,000s – and the property far more difficult to sell or remortgage. If there's less than 60 years remaining, these things become even harder and eye-wateringly expensive.

Therefore, home-hunters should be wary of leasehold properties with a lease nearing, or below, 80 years in length. We've got a whole guide which explains the importance of lease length and how leasehold and freehold properties differ.

Don't accept estate agents' promises of easy extensions. As a compromise, a seller can get the extension ball rolling and pass the rights on to you (you don't have to wait until you've become the owner to extend the lease). The process of extending a lease can take some time, as it involves lots of legal work, which is another reason why it can be worth asking the seller to begin the extension.

And don't just rely on your solicitor to point out a short lease. Make sure you do your own research too, by enquiring about the length of lease up front, and, if it's a short lease, asking how much it would cost to extend. We've been shocked by stories from buyers who said solicitors didn't spell it out.

Forumite Norm says:

I bought six years ago and now my lease has 60 years left. I cannot find anything in the paperwork from the purchase advising me that the lease would need to be extended or that it would be expensive.

I was a first-time buyer and totally reliant on the conveyancer's advice. They should have highlighted this issue. I would not have bought this property if I knew I would have to pay £10,000 to extend the lease.

-

Write a letter to potential sellers

Write a polite letter explaining that you're keen to buy and post it to homes on streets you like. Not only could you get first dibs on a property before others hear about it, but the seller may give a discount, as they might save on estate agent fees.

This really does work. MoneySaver HypnoNu says:

We bought our current house privately. We flyered a load of houses with a photocopied handwritten letter and got a fair few responses. We went to see the house we're in now, and bought directly from the vendor without the house ever going on the market. It's worth a shot!

-

Beware leasehold service charges

Where you own a leasehold property, the freeholder is usually responsible for insuring the building and maintaining communal areas. But the leaseholder (you) typically has to pay ground rent and a service charge to the freeholder.

Service charges can be expensive – papers run stories of freeholders who charge £100,000s for work costing £50,000. Freeholders and property management companies often pick costly providers. Sometimes they grab products and insurance policies that pay the most commission. While you can go to the Leasehold Valuation Tribunal to challenge unfair charges, this can cost £1,000s.

If you're buying a leasehold home, here are some things you should check:

-

Do you have ground rent and service charges in writing? It's important the details are spelled out in black and white and are legitimate.

-

Does the freeholder charge fees for any consents, such as alterations, and to register or transfer mortgages? These can be significant extra costs.

-

Google the property management company. So you can check the reviews.

-

Ask neighbours in the same block if they think the service charge is fair. And whether they get value for money or face aggressive charge collecting.

For more information on the charges and costs you could face as a leasehold homeowner, see our Leasehold versus freehold guide.

-

-

Don't overlook homebuying schemes

If you're struggling to save a deposit, there are various homebuying schemes which might help – though which scheme is right depends on your circumstances.

-

Lifetime ISAs – get a 25% bonus on what you save.

-

Shared ownership – own part of a home.

-

First Homes – get a 30-50% discount off a new-build home.

-

Skipton 'track record' mortgage – a 100% mortgage aimed at renters.

-

-

Are property auctions worth it?

Properties sold at auction can be cheaper than those sold on the open market, but buying this way comes with risk. While properties at auction can seem cheap at first, this doesn't necessarily mean you've got a bargain. Costly renovations are often needed.

Considering bidding? Attend a few auctions first to get a feel for the process. Visit properties several times. You'll need a survey to reveal any horrors – hidden defects might've forced the seller to go to auction.

Always enlist a solicitor to inspect the auction pack. If you buy a property with major legal issues that need sorting, it may not be the bargain you thought it would be. And remember that a binding contract comes into force on the fall of the auctioneer's hammer, so you can't pull out after an auction without huge cost.

See our Property auctions guide for more on how they work.

-

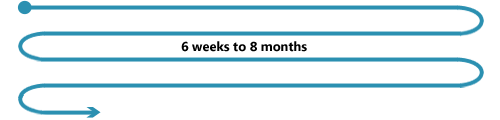

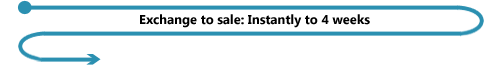

How long does it take to find your dream home?

Here is a typical timescale illustrating how long the buying process can take.

Find a property: Research the area, scour estate agents and search websites.

Put in an offer: Tell the seller what you're willing to pay.

It's accepted: Get a survey of the property sorted. Your solicitor sorts the legals.

Exchange: You pay your deposit and can't back out without major cost.

Completion: Hand over the rest of the cash in exchange for the keys and deeds.

Our Buying a home timeline guide goes through the process in more detail.

-

Remember – there are plenty more fish in the sea

If your offer isn't accepted, don't panic. Keep calm. Keep looking. One day, you'll find the right property and your offer will be accepted.

Do all the checks on each property you see. And if ever in doubt, don't offer.

Looking for more homebuying help?

We've got lots of other helpful guides and tools:

First-time buyers' guide. Getting on that first rung.

Cheap mortgage finding. Find your top deal.

Shared ownership. Own part of a home.

Buying a home timeline. What you can expect.

Buying a new-build home. The steps involved.

Risky properties. Homes lenders don't often like.

Estate agent hard-selling its mortgage broker or solicitor? Watch out for this dodgy practice.