How to check your credit report for free

Get your file and check your score for free

Checking your credit report is in good shape is VITAL if you want to get a mortgage, credit card, loan and much more. And with the cost of living eating into budgets and your perceived 'affordability', having a good history has only grown in importance. Thankfully, there's no need to pay to access your credit report. In fact, some newbies can even earn money for doing so. Here's how to check your credit report.

First, a quick overview of checking your credit report for FREE

You can easily check your credit report and it’s totally free. This shows the payment history and financial details lenders use when deciding on mortgages, credit cards and loans, so it’s vital for spotting errors that could hurt your chances.

Check all three agencies that hold your credit reports. TransUnion, Equifax and Experian hold different data, so check all three at least once a year as they all have an impact.

Use free services. You can get ongoing free access via the MoneySavingExpert Credit Club (TransUnion), Clearscore* (Equifax) or the Experian app.

Look for mistakes. Check addresses, old accounts, unfair defaults and financial links – especially before big applications, to cut the risk of rejection or worse rates.

Soft checks only. Viewing your own report doesn’t harm your score, as it’s recorded as a soft search lenders can’t use.

For tips on improving your credit rating, see our Credit scores guide.

Why and what you should check

There are three credit reference agencies; Equifax, Experian and TransUnion. They all hold information on you and your payment history which lenders use. Even small errors can cause problems, so it's important you check through your credit history. Most of this is explained in detail in our How to boost your credit scores guide, but below is a quick checklist:

-

Check addresses on old accounts.

-

Fight unfair defaults on your file to boost your score.

-

Ensure you financially de-link (in other words, separate) if you no longer have joint accounts with someone.

-

Rejected? Always check your credit reports when you're not approved.

-

Cancel unused credit and store cards. Find out why unused cards can count against you.

Should I check all three credit reports?

If you're doing a specific application for a company (for example for car finance) and you know which credit reference agency it uses, it's obviously a priority to check that one. But as a general housekeeping rule we suggest you check all three credit reports at least once a year, because they all have an impact.

Don't worry about over-checking your credit file. Your checks are only recorded on your report as soft searches, which lenders either don't see, or if they do they can't use them in making lending decisions.

When you do check your reports, make sure you check EVERY detail and do it regularly. PLUS always check before making any big applications to minimise your risk of rejection when lenders do a credit check on you. Even if you are accepted, your score could affect the interest rate or credit limit you are offered.

How to check your full credit report for FREE

It used to be that the only way you could check your full report for free was to sign up to 30-day free trials with the credit agencies, and then cancel before the time's up so you don't get charged. Yet these days there is more choice out there, and even the chance to earn money for checking.

Which way you choose to check your report will depend on what's most important to you – a full bells and whistles credit-monitoring service free for 30 days, or a more basic, but free-for-life service.

Here's how to do it, broken down by agency:

TransUnion

Here's how to view your TransUnion credit report for free:

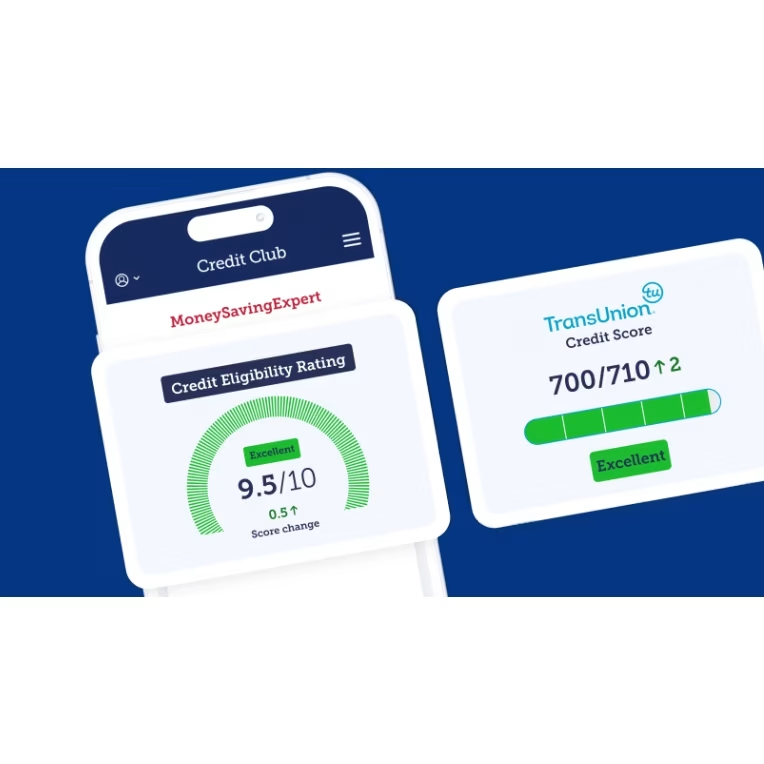

MSE's Credit Club shows your real-world credit power – which translates to acceptance for credit cards, loans & more – and explains how to improve things.

It uses a new Eligibility Rating which combines the THREE crucial factors that dictate whether a lender will accept you, to show a far bigger picture...

1) Your credit score

2) Your affordability score (which, crucially, includes income)

3) Current market conditions

Once logged in, it'll show your TransUnion credit report and score. Plus, it’ll give you access to our eligibility calculators for credit cards, loans and mortgages, allowing you to see the deals you'll most likely be accepted for, without impacting your ability to get future credit.

How to cancel a Credit Club account?

It's easy. Just log in to your account, go to 'Settings' then click the big red 'Delete My Account' button. But if you're leaving we'd like to know why – please email us so we can fix any issues.

Or alternatively...

-

Credit Karma. Your TransUnion Credit Report information will be updated every seven days. Apply online or via Credit Karma's app.

-

Credit Score – free access to your TransUnion report. Credit Score is powered by MoneySupermarket.com, and also offers completely free access to your TransUnion Credit Report and Score.

-

TransUnion's statutory credit report. A free credit report that you've got a legal entitlement to. A statutory credit report is done online, so it's quick and easy to access, but it won't usually include any 'extras' you get with some subscription services, such as a guide credit score.

Experian

There are a few ways to get your Experian credit report. Here's how:

What you get: See your full Experian Credit Report and Score via the Experian app. It’s a free service, and if you already check your Experian Score, you’ll use the same log in. If you haven't already got an account you can go via Topcashback and get £9 back.

This is a limited service, however. You get to see your report and score, but if you want Experian's insights on how to improve your creditworthiness, it directs you to its paid version (more on that below).

Don't want to use an app, or want to know how to improve your score and more?

What you get: Experian's CreditExpert* offers new customers a "free 30-day trial, then £14.99 a month" service. It gives you real-time access to your Experian Credit Report, but also offers insights on how to improve your score and why it might have changed.

You can only do the free trial once. And a new customer is somebody who's never used CreditExpert before (though you can have been a member of Experian in the past).

Get PAID to use CreditExpert: If you're new to both Experian and CreditExpert, you can earn £5 cashback for signing up to CreditExpert via this Topcashback* link.

How to cancel your CreditExpert account: To cancel your subscription, log into your account and go to 'My Subscriptions'.

Or alternatively...

-

Experian's statutory credit report. A free credit report that you've got a legal entitlement to. A statutory credit report is done online, so it's quick and easy to access (although with Experian's you will need to wait up to 5 working days for a passkey to come via post), but it won't usually include any 'extras' you get with some subscription services, such as a guide credit score.

Equifax

Here's how to view your Equifax credit report for free:

Clearscore* – free access to your monthly Equifax Credit Report

What you get: Clearscore* provides free Equifax credit scores and reports, updated once a month, and also has an eligibility checker. Clearscore's basic services are free for life.

Clearscore sometimes needs basic details about which bank you're with in order for you to sign up. For instance, Clearscore might ask you to confirm the first two digits of your banking sort code and last six digits of your account number. These details are only used to match you to your credit report and are not saved.

How to cancel your Clearscore account: Go to your 'My Account' page, and click on 'Delete My Account'. You'll be sent an email to confirm your request has been processed.

Or alternatively...

-

Equifax Basic. This is a free service offering a monthly credit score and a statutory credit report.

-

Equifax's Credit Report and Score – free 30-day trial. Equifax offers a 30-day free trial, then £14.95 a month. The paid-for service gives you access to your real-time credit report as well as daily email alerts whenever there are changes to your account, like a new search. To avoid being charged, you'll need to cancel your subscription at least 24 hours before the free trial is up. You can do this by going through 'My Account' and then 'Product Management' – alternatively you can cancel by calling 0800 014 2955.

-

Equifax's statutory credit report. A free credit report that you've got a legal entitlement to. A statutory credit report is done online, so it's quick and easy to access, but it won't usually include any 'extras' you get with some subscription services, such as a guide credit score.

How to check all three in one go

CheckMyFile gives you a 7-day free trial to see your Experian, TransUnion and Equifax reports in one place. After that, it's £14.99 a month. This trial period is pretty short, so be sure to set a reminder to cancel it if you don't want to be charged.

To cancel, either call 01872 304050 or log into your account, then click through 'Expert Help', 'I need help with my account' and then 'I'd like to stop my subscription'.