How to build your credit history as a student or young person

Beginner's guide to building a credit history

Credit scoring is about predicting your future behaviour based on your past. So for young people or students with no past, this can cause rejection for a loan, mortgage, bank account, phone contract or energy tariff. We explain how you can start climbing the credit rating ladder and boost your chances of bagging good products.

What is a credit score?

When you apply for credit – like a credit card, mortgage or loan – the lender tries to predict your future behaviour based on your past. Essentially, they want to know how likely it is they'll get their money back with no issues.

Lenders look at a range of data, such as your current debts, any applications you've made recently, the credit products you've had and whether you repaid them on time.

Some of this comes from lenders' own information, but much comes from the credit reference agencies Experian, Equifax and TransUnion.

The term 'credit score' can refer to a credit reference agency's view of how a typical lender may view your credit history. But it can also refer to how a lender specifically sums up your credit history with its rating, based on all of the information above.

This isn't easy if you have little or no credit history – would you lend to someone you've just met with no track record of paying off their debts on time? We take you through how to build up this history below, to increase your chances of being accepted for credit.

The 12 things to know to build your credit history

Debt is like fire – used right it's powerful, but used wrong it burns.

The aim of this guide is not to encourage borrowing, Rather, it's to build a decent credit history which not only helps you get other credit later on, but helps you to access cheaper interest rates.

Even if you don't use credit cards or loans now, your credit history will affect you sooner or later, so the earlier you start building a good credit history the better.

This guide is primarily for young people and students new to the world of credit. If you've already got going, see our Improve your credit score guide for full help and tips.

-

You need a credit history to get credit

You need a credit history before lenders will lend to you. But the catch-22 is how to get started if no one will lend to you because you haven't borrowed before...

When you apply for a product, a 'credit check' is done. This means lenders put all the data they have on you into a complicated algorithm in an attempt to predict your future behaviour based on your past. While a poor history counts against you, so does having little credit history as it makes predictions less certain.

In reality, credit history affects your ability to get the following:

- Mortgages

- Credit cards

- Bank accounts

- Loans

- Utility bills paid via direct debit

- Broadband

- Landline phone and mobile phone contracts

- Car and home insurance

- Buy now, pay later productsCredit scores can't cross borders.

So even if you built up a good credit history outside the UK, if you're new to the UK this essentially means you'll need to start your credit history again.

Experian, Equifax and TransUnion build credit reports using information from UK accounts, so if you're new to the UK, you'll probably find your report looks quite bare, which may impact your ability to get credit.

Start building your UK credit history as soon as possible, though keep copies of your credit history from abroad as it may help with applications.

I'm new to the UK – does my credit history from abroad count?

Martin Lewis explains how credit scoring works (the pub version)

Martin Lewis explains how credit scoring works (the pub version) -

Register to vote or it can be harder to get credit

One of the first steps to build a credit history is registering to vote.

When you apply for credit lenders will check your identity. If you're on the electoral roll, this will be recorded on your credit file – which helps the identification process.

If you're a student it doesn't matter whether you're registered at your family home or term-time address, though any application for credit should be linked to the address you're registered at (otherwise you're more likely to be rejected).

-

Get a specialist student bank account

At 18 or 19 years old, no one expects you to have built a credit history yet. But if you're a student, banks have special student accounts which give you the ability to borrow – these are your gateway into the world of credit.

When you open a student account, you can apply for a 0% overdraft. Offering limits of up to £3,000, the actual limit tends to be lower, especially for first-years.

Don't just open a student account with the bank you've had an account with when you were young – rather, see our Student bank accounts guide first.

Manage a student bank account properly

Immediately spending £1,000s and busting your overdraft limit will likely leave lenders thinking you can't be trusted with money (you'll also be hit with charges).

While your overdraft rate will be 0%, only use it for cashflow issues, not regularly.

Add up your student loan, plus any grants, income from employment and money from your family. This is your income for the term and what you should be using when figuring out how much you have to spend each week.

-

A credit card can help you build a credit history, but only if you use it responsibly

There'll come a time, whether at university or at another early point in your credit journey, when a credit card company will target you for one of its cards.

Credit cards aren't inherently a bad product, but in the wrong hands they can be...

The best cards normally require a decent credit history, but some cards are designed for people with a poor or no credit history. Yet as people using them are riskier for lenders, the cards are expensive – interest rates of 34.9% are common.

If you use these cards sensibly though, you won't ever pay this interest rate:

➡️ Ideally, use these cards for planned, normal spending each month.

➡️ Pay the card off in full and on time each month.Follow this approach and you'll reap the credit file benefits – as it'll show you can use credit responsibly. See our guide for the Best credit (re)build cards for more.

Even if you're struggling to make a payment one month, try not to default or miss the payment – it can be a massive hit to your credit history and may cause issues for years. If you are in difficulties contact your lender (hopefully it will try to help).

Warning. Don't do this if you don't have financial discipline. Credit cards allow you to spend more than you can pay back, even ones with low credit limits.

-

Always check your credit card eligibility first

Whenever you apply for a credit card, this leaves a search mark on your credit file. Too many search marks make you look desperate for credit – and can be a cause of rejection.

To combat this, we built our eligibility calculator.

It allows you to see which cards you've the most chance of getting before you apply – and it doesn't leave a mark on your credit file that lenders can see (it does what's called a 'soft search', which means you can see the search, but lenders can't, so there's no impact on your credit file).

-

Stability counts when building credit history

You might live at four or five different addresses during your student years. That's going to hinder you when it comes to applying for credit.

As lenders like stability, they're looking for you to live in one place. If you can, use your family home address for all your financial accounts. Keep application details the same between all accounts – the same address, phone number, bank details.

This consistency will help to demonstrate you're a responsible and stable person, not someone they would have a harder time tracing if you didn't pay them back.

-

Check your credit report regularly

There are three UK credit reference agencies: Experian, Equifax and TransUnion.

These agencies store the details which make up your credit report. Over time, your bank and any credit card providers you have will share data with at least one (and maybe all) of these agencies on how well you manage your account.

It's worth keeping an eye on your credit report for several reasons:

-

Check for credit file errors. If your credit file contains any inaccuracies, these can scupper applications for credit. See how to Repair credit file errors.

-

Keep an eye on your credit history. Each agency gives you a credit score based on your history. The more you do to improve your credit history, the higher your score – and the greater chance you'll be accepted by a lender.

Checking your credit report is free to do. See our Check your credit report guide.

-

-

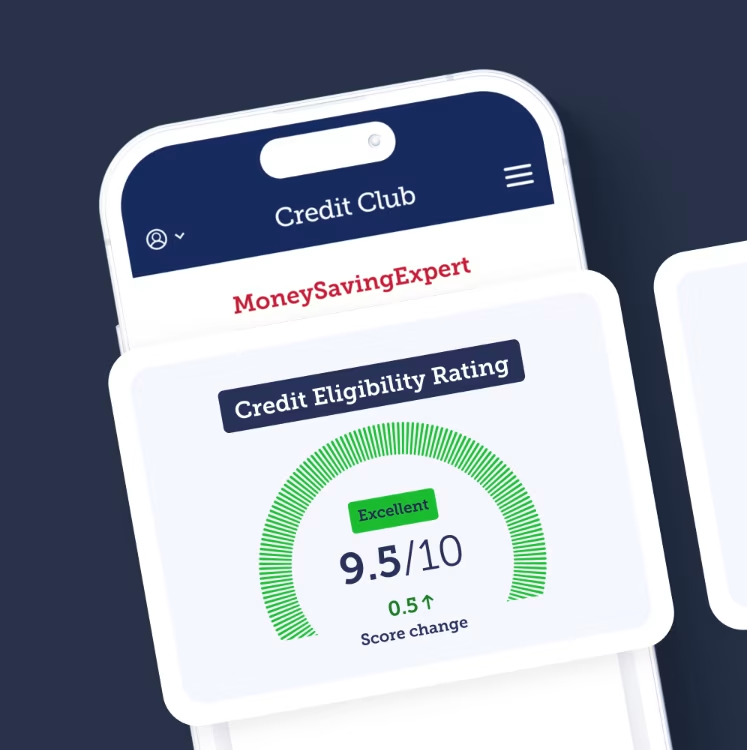

Get started with MSE's Credit Club

MSE's Credit Club

See your real-world credit power – translating to acceptance for credit cards, loans & more – and learn how to improve with MSE Credit Club.

MSE's Credit Club uses an Eligibility Rating which combines the THREE crucial factors that dictate whether a lender will accept you, which are:

💥 Your credit score

💥 Your affordability score (which, crucially, includes income)

💥 Current market conditionsOnce logged in, you can see your TransUnion credit report and score. Plus, you'll get access to eligibility calculators for credit cards, loans, mortgages and more, allowing you to see the deals you'll most likely be accepted for, without leaving a mark on your credit file.

-

What lenders really know about you

There's plenty of misinformation around what lenders know about you when you apply for credit. Their knowledge is more limited than you might think.

It includes:

✅ Information on your application form.

✅ Information from any accounts you've had with them before.

✅ Your credit history, obtained from one of the credit reference agencies.And that's it. Read what lenders DO know and what lenders DON'T know.

-

Don't let flatmates' credit histories wreck yours

If you're renting a flat or house, your flatmates' credit histories could affect yours.

If you're both (or all) named on broadband, gas or electric bills, then it's possible that a financial link will be created on your credit records. This means that lenders can search linked persons' credit records when you apply for credit.

And if they don't like what's on others' credit files, it could result in a 'no' for YOU.

See full information on how to financially delink from another person.

-

Payday loans can KILL credit applications

Some payday lenders disingenuously suggest payday loans that are repaid on time boost your credit score, as it builds a history of repayment. This is true to a very minor extent for those with abysmal credit histories – but in reality using a Credit rebuild card correctly is more effective and far cheaper.

While most payday lenders won't touch students (as you've no regular income), there are some that do. Avoid these firms like the plague.

Payday loans have hideous interest rates, and many lenders won't lend to you if they see you've taken recent payday loans. Read more in our Payday loans guide.

-

Don't panic if it all goes wrong

The tips in this guide are designed to help you build a good credit history as early as possible. But there's a chance that at some point you'll get something wrong – possibly a forgotten or missed payment, or too many credit applications.

The first thing to say is: don't panic. This is especially the case if it happens while you're young, as time is a great healer. Your payment history's recorded for six years, so by the time you're in your mid-20s, earlier mishaps will have vanished.

While anyone you apply to for credit will be able to see six years of history, they'll give the most weight to the most recent year or two. So, provided you quickly get back on your feet, any slip-ups shouldn't derail your financial future.

Other credit and student guides...

Check your credit report. It's free to do.

Improve your credit score. Top tips and how-to.

Credit cards for bad credit. Rebuild your history.

Student bank accounts. Find best bank accounts.